Exports: Services save the day

Non-oil exports decline, but manufacturing and services pull through

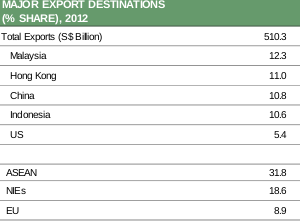

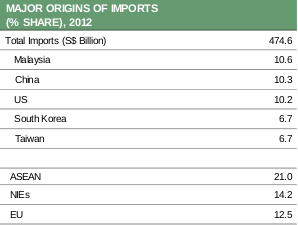

The data released by the Monetary Authority of Singapore (MAS) in September revealed that while non-oil domestic exports declined a further 5% year-on-year (y-o-y) in the second quarter (Q2) of 2013, on top of a 12.5 (y-o-y %) decline in the first quarter, the GDP growth expanded by a significant 15.5% q-o-q saar (quarter-on-quarter seasonally- adjusted annualised rate).

“Notably, the manufacturing and trade-related services industries recorded firm gains, indicating

that growth is broadening to the external-oriented activities, from the more domestic demand-reliant expansion seen in previous quarters,” the MAS said. Buoyant by this, the authority upgraded the growth forecast for this year to 2.5–3.5%, from 1–3% previously.

This is the first time in three years that the Singapore economy has posted three consecutive quarters of sequential growth. The trade-related industries—which comprise manufacturing, wholesale trade and transport as well as storage—surged by 26.6% q-o-q saar in Q2, following a contraction of 9.1% in the preceding quarter.

Manufacturing

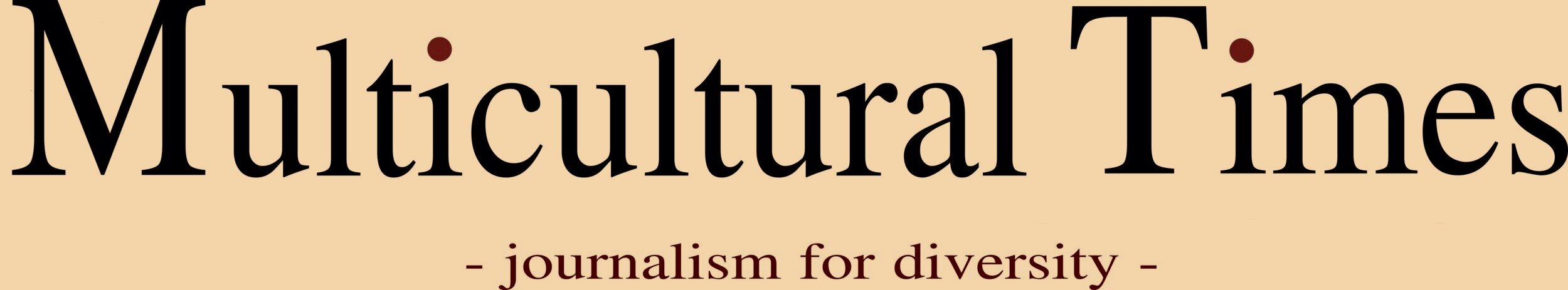

The manufacturing sector expanded by 32.1% q-o-q saar in Q2, from -12.1% in the earlier quarter. Both non-electronics and electronics output recorded firm gains. In particular, the former was buoyed by strong expansions in pharmaceutical and marine & offshore engineering activities. “Excluding these two volatile segments, however, non-electronics output remained largely flat in Q2,” said the authority.

Electronics

Meanwhile, the electronics sector continued its rapid upward trajectory, with output growing at more than twice the pace in the preceding quarter, with gains across all segments. Notably, semiconductor production accounted for almost half of the increase in electronics output, amid a pick-up in the prospects for the global IT industry.

Financial services

Apart from the non-oil domestic exports, bad news also came from the financial services sector, which grew by 9.2% q-o-q saar in Q2, down from 51.2% in the preceding quarter. This was due to the sentiment-sensitive cluster experiencing some pull-back as concerns over Quantitative Easing tapering dampened investor confidence towards the end of Q2, noted MAS.

Port is still strong, for now

Despite a uncertain global economy, challenging maritime climate, and rise of several port cities in China such as Shanghai, Singapore's port throughput in 2012 reached 31.6 million TEUs, which is a historic high. Moreover, Singapore continues to be the world’s busiest port by vessel arrivals, with 2.25 billion gross tonnes (GT) in vessel arrival tonnage last year, along with being the world’s top bunkering port with bunker sales totalling 42.7 million tonnes for 2012. To hold on to the city-state's maritime competitive edge, a new port is being built in Tuas, which will be operational in 2027. It will be bigger, more efficient, almost double the present capacity and will reduce costs substantially by eliminating inter-terminal haulage. The Tuas port will consolidate all port operations in Singapore currently spread across Tanjong Pagar, Keppel, Brani and Pasir Panjang.

All the above figures and tables are taken from MAS' Recent Economic Developments in Singapore booklet released on September 5, 2013.